Liquidity Risk: In the case of contracts involving future date payments denominated in foreign currency, which might affect the credibility of the buyer or borrower. Credit Risk: Default risk in case the buyer or borrower is unable to pay. Exchange Rate: It occurs in case of the difference between the date of the transaction contract made and the transaction executed, for, E.g., Credit Purchase, Forward Contracts Forward Contracts A forward contract is a customized agreement between two parties to buy or sell an underlying asset in the future at a price agreed upon today (known as the forward price). The following risk involved in Transaction exposure: Buying and selling, lending, and borrowing, which involves foreign currency, have to face transaction exposure. Such exposure is faced by a business operating internationally or dependant on components, which needs to be imported from other countries, resulting in a transaction in foreign exchange. Transaction Exposure occurs due to changes in the exchange rate in foreign currency. You can download this Risk Exposure Excel Template here – Risk Exposure Excel Template #1 – Transaction Exposure

If an investor decides to divide investment into all three options, risk exposure would be adjusted, and he will benefit from all three assets. Although investment option C looks attractive with higher returns, the risk involved is also higher, 12%.

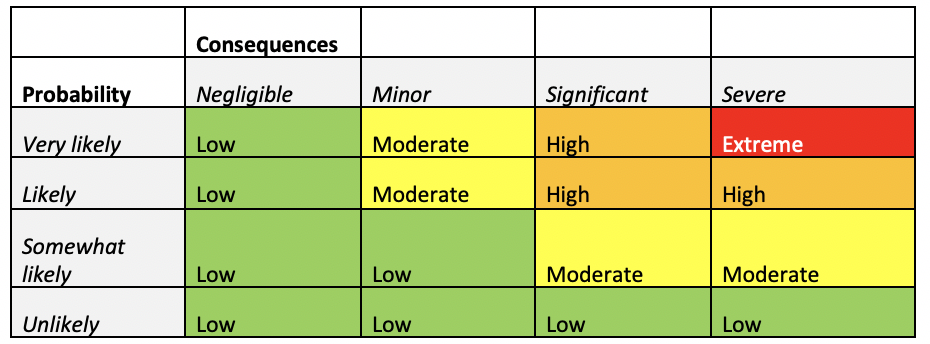

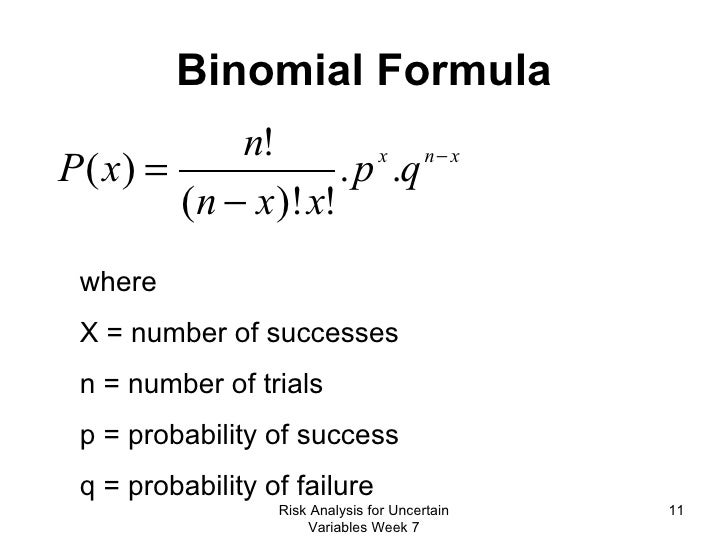

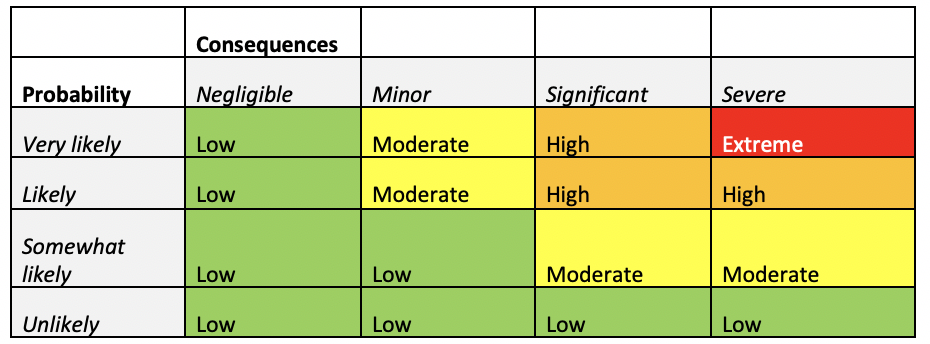

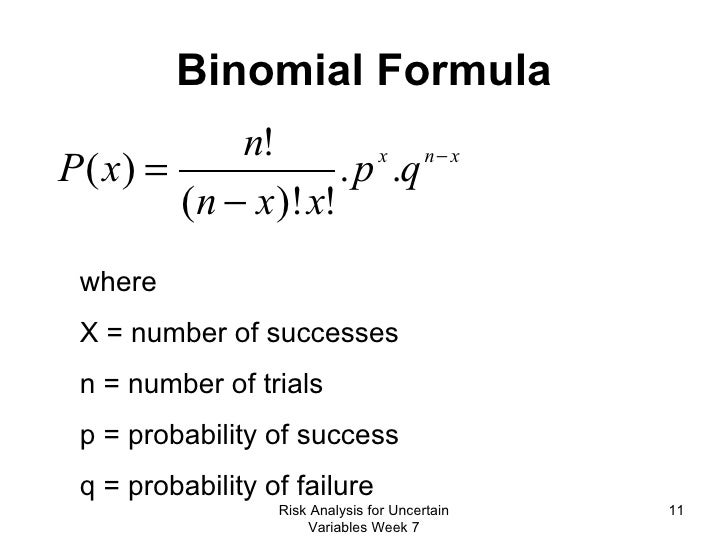

An investor wants to invest $500,000 in the market for one year.Īn investor has to make a decision in which investment option he prefers to invest. There are three investment options available for an investor, which he needs to decide. Risk Exposure formula = Probability of Event * Loss Due to Risk (Impact) Example Although specific risk involved in business cannot be predicted and controlled, the risk which is predictable and can be managed are calculated with the following formula:

0 kommentar(er)

0 kommentar(er)